Vision

To enhance Indian financial inclusion by offering range of financial services to micro entrepreneurs

Mission

To adopt advanced technology to cater financial services to micro entrepreneurs and low income households through banking partners.In addition, identify, promote specific skill sets needed by industry at local areas

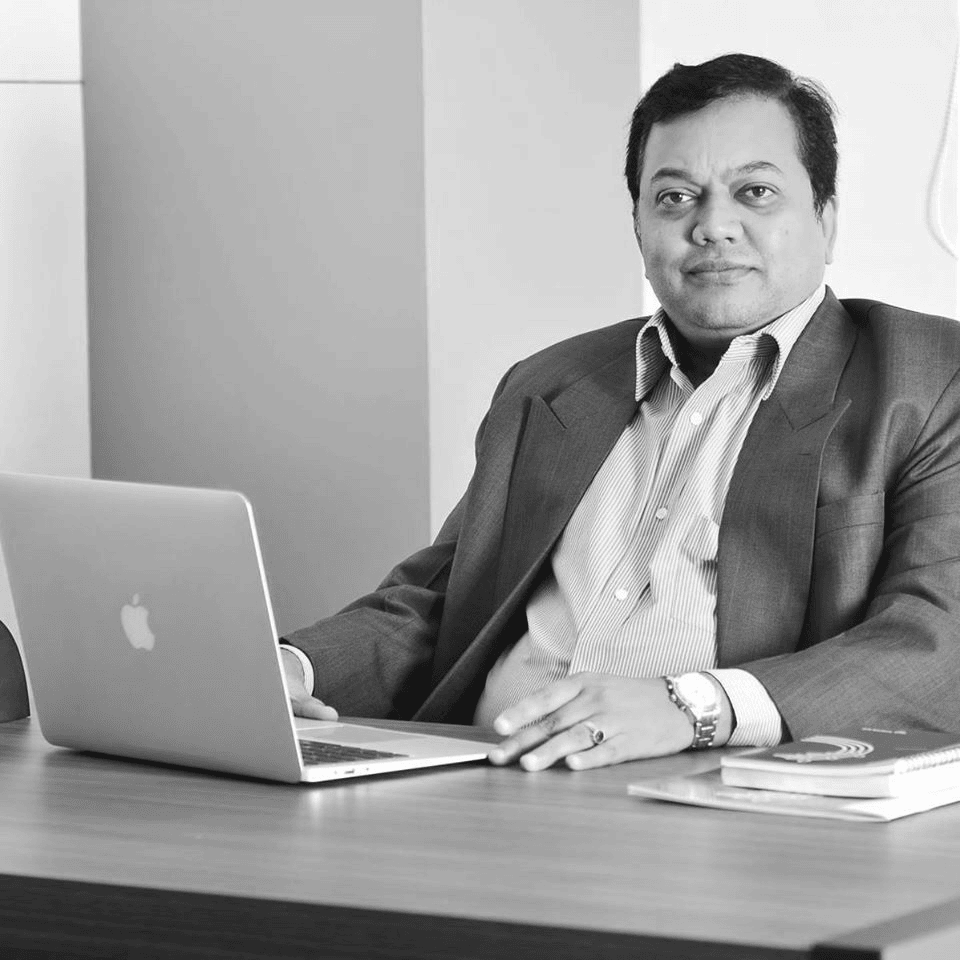

Mr. S. Ramachandran

Co-Founder & CEO

He is a Bachelor of Commerce and a Chartered Accountant from Chennai. Over two decades, he has served in NBFCs specialized in micro- finance. He joined BASIX, a leading NBFC-MFI in late nineties, At 2010, the portfolio was INR 25 billion with over 200 branches. He also worked on BC model in KBS Local area Bank and BASIX Sub-K i-transactions Limited. He became Executive Director and was on BASIX Board in 2010. In 2017, he joined Asirvad Micro-Finance Limited as COO, AUM was scaled up from INR 18 billion to 60 billion by 2021 and Asirvad became 4th largest MFI in the Country. With the passion of serving millions of households through microfinance over two decades, he decided to co-promote SHARVAGYAA Finance.

Mr. S. G. Mahesh

Co-Founder & COO

S G Mahesh comes with close to three decades of experience in Lending to Micro Enterprises, Asset Backed Finance and Unsecured loans. He has been associated in various capacities across companies like Sundaram Finance, Citigroup, Fullerton India, DCB Bank, HDB Financial Services, Vistaar Finance, Asirvad Micro Finance Ltd. His last assignment was with The Muthoot Group as Business Head – Unsecured Lending. Apart from demonstrated excellence in driving Sales and PBT, his area of expertise is Channel Management, Credit & Receivable Management and in managing large teams. During his previous assignments he has has been a part of the Senior Management Groups. He is an Alumnus of St. Joseph’s College, Bangalore and Has completed a Management Certification Program from XLRI Jamshedpur.

Board of Directors

Mr. K. Srikanth

Founder Director

He is a Bachelor of Commerce from the University of Madras. He has 35 years of Corporate experience across diverse sectors. In 1984 in TN Petroproducts Limited part of SPIC group as a PRO. He became a General Manager in a NBFC (Foresight Financial Services Ltd – SEBI category 1 merchant Banking) of SPIC group and later became a Director. Held position of Directorships in several finance companies. He had been closely working with big conglomerate like Larsen &Toubro. One of its stake holders DRA HOMES starting their operations in Chennai and he became as CEO with turnover of Rs 200 crore and projects worth Rs 1000 crore has been executed. He continues to be their advisor.

Mrs. Sandhya Ramachandran

Founder Director

She is a Bachelor of Commerce and a Chartered Accountant from Chennai. She has worked with many large corporate groups like Voltas, Tata’s, Birla etc. She has worked in different industries like telecom, IT, BPO etc. for nearly two decades. She began her CA Practice in 2014 as a partner of the Hyderabad Branch undertaking various bank audits, stock audits, statutory & internal audits. She has an independent practice in Chennai and engages in Internal Audit, GST Audits etc. She is a senior management professional and has specialization in Finance and Accounts and proven experience in revenue assurance.

Mr. S. Ramakrishnan

Mr. S. Ramakrishnan

Independent Director

Independent Director

Mr. Ram Sowmithiri

Independent Director

He worked as Project Manager in Tamil Nadu Women’s Development Project supported financially by International Fund for Agricultural Development (IFAD). This was the first major initiative on a large scale (a US $ 30 million Project) for promoting rural women’s Self Help Groups and using that as the platform for empowerment of poor rural women. This Project was extremely successful and known for its quality orientation. Later on, larger poverty alleviation initiatives elsewhere in the country were modelled on this project. Joined BASIX Group as Manager and later In April 2001, he was appointed as COO for Sarvodaya Nano Finance Limited. In August 2003, he was appointed as MD of SNFL, which had scaled up to more than Rs 100 crore AUM.

Annual Return 2022-23 :

1. AGM Notice

2. Board Report

3. Audited Financials

Business Partners

Our partners play a major role in increasing our business performance.